Blog

SAP Central Finance and Central Payments are the Foundation for Finance Shared-Services Model

Our clients are often forced to allow acquisitions to operate independently due to technology limitations. This limits the efficiencies and cost savings realized from a merger. Moving to a shared-services model in the finance arena is the foundation for recognizing the benefits of a merger. Central Finance and Central Payments should be the foundation for a shared services business model. By leveraging S/4HANA Simple Finance “digital core” functionality and Central Finance features in release 1909, the shared-services vision will become a reality.

Functionality Overview and Supported Scenarios

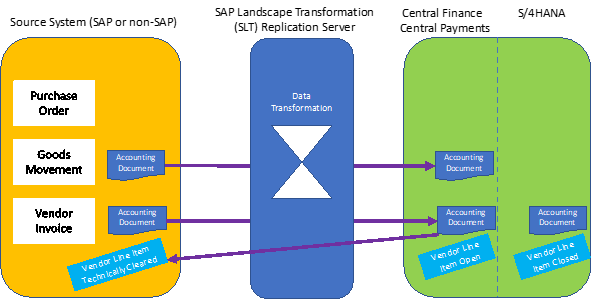

With SAP S/4HANA and Central Finance, all financial postings — Financial Accounting (FI) and Managerial Accounting (CO) documents — are replicated in real time to the Central Finance system. This replication results in the real-time posting of accounting documents into S/4HANA finance. Prior to SAP S/4HANA 1709, all AR and AP open items were replicated from source systems to the Central Finance system, but these documents had to be paid or cleared in the source systems. With Central Payments functionality in SAP S/4HANA 1709, these open items are replicated from SAP ECC systems to the Central Finance system and also paid or cleared directly from the Central Finance system. The open items are technically cleared in the source system immediately once they are replicated to Central Finance. Figure 1 provides an example of the document replication for a procure-to-pay process.

Figure 1 — Central payments solution architecture overview in Central Finance

SLT will replicate the payable accounting document into Central Finance, and S/4HANA and technically clear the document in the source system. The SAP Landscape Transformation server will also transform the data during replication. An example may be the source system account structure may be different than the new structure in S/4HANA. SLT will switch the account number to match S/4HANA before replicating the document. The replicated payable is open in S/4HANA. After the payment run has been completed in Central Payments, the open item is cleared just as any open item generated in S/4HANA. This same process follows for any accounting document replicated from the source system. Prior to the release of 1909, this capability was limited to only SAP ECC source systems but is now supported for third-party source systems. Several key features available in Central Finance are:

- Central collections and dispute management for receivables

- Central bank account management

- Centralized uploading of bank statements, processing, and cash application for clearing

- Inter-company reconciliation of AR and AP open items

- Centralized receivables and payables reporting

- Integration with SAP in-house cash functionality for improved working capital management

- Centralized value-added tax (VAT) and deferred tax reporting

New features in S/4HANA 1909

There are several new features available in the 1909 release of Central Finance for third-party (non-SAP) systems:

- Complete clearing of one invoice with one payment

- Clearing of one invoice by down payment

- Partial clearing of one invoice by partial payment

- Clearing several invoices by payment

- Replicating and updating clearing information for residual items

- Clearing by credit memo

- Clearing of several invoices by one payment

- Update of withholding tax from original invoice

- Reverse payment and reset clearing

One key benefit of S/4HANA is the integration of Profitability Analysis (PA) into the Universal Journal. This allows every transaction in S/4HANA to have characteristics assigned in real time to aid in financial analysis. With the 1909 release and proper mapping in SLT, these same characteristics can be assigned to third-party accounting documents that are replicated via Central Finance. This is a huge leap forward in reducing the workload in a shared-services model. These features allow a subsidiary to operate independently yet deliver real-time, integrated financial performance for corporate executives.

Realizing the Vision

You may have discerned that to realize this vision you need both S/4HANA and Central Finance. If your company is a large enterprise considering a transformation to shared services, migrating to S/4HANA is a huge undertaking. Ameri100 and SAP have developed a road map to remove risk and minimize disruption for this process.

Our approach leverages Central Finance to allow S/4HANA to be implemented as a greenfield project. This can be done even as you operate your previous ERP independently. You can implement S/4HANA without concerns over years of enhancements made in your SAP ECC system. This road map migrates master data and finance operations to S/4HANA while remaining business operations remain in ECC (or other third-party systems). You will be able to leverage S/4HANA for all of the innovations, including many of the following:

- New GL accounting: multiple accounting-based ledgers

- Unification of Finance and Controlling using Universal Journal for real-time integration, seamless management reporting, and faster period-end close

- Replacement of aggregate and index tables by Universal Journal enabling a single source of truth for all reporting

- Business partner functionality to unify vendors and customers and reduce master data maintenance overhead and limitations

- Seamless depreciation postings to multiple ledgers using the new asset accounting functionality

- Account-based COPA as the default for easier profitability analysis with G/L accounts

- Inventory valuation in multiple currencies across companies using Material Ledger functionality

- Ability to make quick decisions using graphical dashboards. (i.e., monitoring material/coverage)

- MRP live functionality, predictive analytics for material shortages, enhanced capacity planning functionality

- Embedded real-time analytics and multi-dimension data sources (CDS views) reduce dependency on building custom analytics using BI tools

- Easy integration with third-party tools using whitelisted APIs and SAP Cloud Platform

- Increased intelligent capabilities like AI, ML, and RPA

- Credit management deprecated in FI and SD module and available as FSCM

- Configuration of house banks through Fiori apps

- Multiple custom T-Codes replaced via standard functionality

We are available at your convenience to answer any questions you have about SAP Central Finance. Ameri100 has the business acumen and S/4HANA expertise to make it happen. For more information on Central Finance, fill out the form below, and we will share our white paper “Ameri100 Central Finance Roadmap.” Check back soon for more posts on Central Finance or subscribe to our blog to receive weekly updates.

Interested in learning more? Contact us or reach out the the author directly!